With the potential for an enormous agenda, including work requested by the chancellor as well as our own initiatives, at the Office of Tax Simplification, we have to be thoughtful about how we prioritise. In order to benefit taxpayers as widely as possible, we plan to look in a broad way at the ‘user experience’ of those interacting with the tax system, and to examine the impact of tax at points in the life cycles of businesses and at key points in the lives of individual taxpayers. We are keen to hear from Tax Journal readers as we develop our plans for the next 12 months, one to three years and beyond (at ots@ots.gsi.gov.uk).

Why simplify tax? After all, UK taxpayers have access to one of the world’s finest tax professional communities and HMRC provides as much guidance as any other tax administration, if not more. There is a tradition in the UK of making specific provision for a wide range of circumstances in the interest of fairness and consistency. What is comprehensive in a complex world is unavoidably voluminous. There may even be some who rather enjoy delving into the intricacies of our labyrinthine tax system!

On the other hand, strictly applying the principle of ‘ignorance of the law is no excuse’ to some 20 million words of tax legislation would be somewhat heroic. So, on a practical level, it is clearly essential that individuals and those running businesses are able to understand their tax obligations and liabilities. The outcome should be certain, clear and intuitively reasonable.

Business owners should be able to focus their energy on running their business, rather than grappling with the tax system. It is as important for productivity as it is for the competitiveness of the UK in attracting inbound trade and investment.

These objectives – certainty, clarity, results that are intuitively reasonable for individuals and productivity and competitiveness for business – provide the basis on which we will prioritise our work. We will look to make a positive difference for the greatest number of people on the greatest number of occasions. This means that aspects of the tax system which affect people generally or which impact on small businesses will be a particular priority. Measures which improve the experience of those interacting with the tax system will be just as important, if not more so, than technical simplifications and changes in the underlying legislative structure.

Where there is an opportunity to secure a ‘quick win’, we will point to that. There will also be other cases where there is no quick win and where the number affected may be small but it is simply ‘the right thing to do’. An example of the latter would be paper stamp duty, where there is an opportunity to modernise some quaint but rather antiquated practices! At the core of our work, however, we will focus on the ‘user experience’ for the majority of taxpayers.

There is enormous support for tax simplification. In his inaugural speech as president of the CIOT, John Preston emphasised ‘the unquestionable need to simplify the UK tax system’. The Conservative Party manifesto recognised that: ‘A good tax system is not just about the headline rates of tax, however, but about its simplicity. Our system remains too complicated, making it hard for people – especially self-employed people and small businesses – to assess their taxes.’

The Office of Tax Simplification (OTS) is now formally established under FA 2016 Part 12. Section 184 provides for continuation of the OTS, initially created in 2010 on a less formal basis. This came into effect on 28 November 2016 under The Finance Act 2016, Sections 184 to 188 and Schedule 25 (Commencement) Regulations, SI 2016/1133, which might prompt the thought that legislating for the continuation of the OTS was, perhaps, not so simple after all.

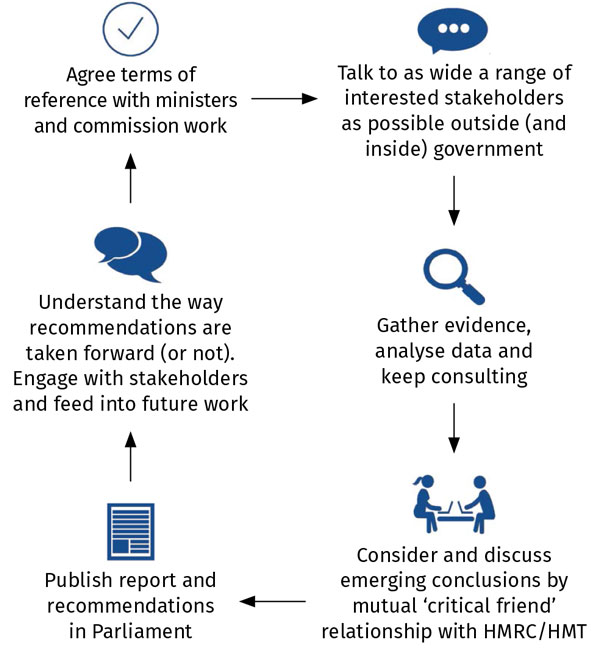

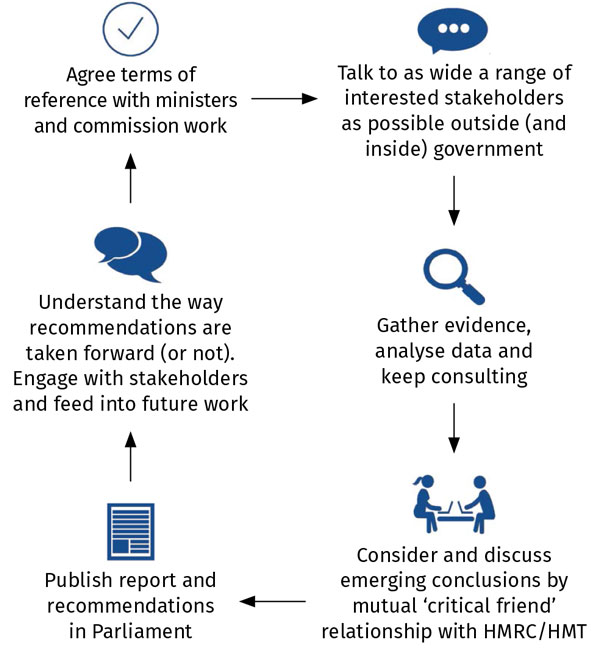

Section 185 provides that the OTS must provide advice to the chancellor, on request or as the OTS considers appropriate, on the simplification of the tax system, which, under s 185(3), includes improving the efficiency of its administration. The scope of the OTS extends to all taxes collected or managed by HMRC, including duties and NICs. Where a review is requested by the chancellor, the report is published and laid before Parliament.

Our recent publications include our interim report on VAT and our focus paper on complexity, published in February, and our further papers on complexity published in March, including the complexity index. The focus paper on complexity considered the length of legislation, thresholds, whether layered legislation could offer a different approach, definitions and some general principles on avoiding complexity in the tax system.

We identified four principles for avoiding complexity: policymakers should ensure the proposed tax measure meets the policy aims; focus the measure carefully; design the measure to meet the aim; and maintain the measure properly.

In January, the CIOT, Institute for Fiscal Studies and Institute for Government published their Better Budgets report, which outlined ten steps towards making better tax policy. The recommendations included publishing clear guiding principles and priorities for tax policy, improving consultation and the opening up of public debate. We hope that our focus papers will continue to contribute to, and inform, this public debate.

Also in March, we published our interim report on stamp duty on paper transactions and we will shortly be publishing a report pointing the way forward in modernising the UK’s oldest remaining tax.

The tax system needs to adapt to an increasingly digital economy, a world in which work takes an ever wider range of shapes from traditional employment, to all kinds of independent working and the ‘gig economy’. The ‘sharing’ economy provides new challenges for the tax system as assets can be monetised in a variety of ways. Big data analytics, robotics, artificial intelligence, distributed ledgers (block chain), bitcoin and other technology developments pose further challenges. We will be exploring ways in which we can use technology to make tax simpler, as well as ways in which it is hard to stop technology making tax more complex or uncertain.

We will be asking questions about attitudes to tax simplification. For example, would taxpayers be prepared to pay marginally more tax in some situations if the outcome was more simple and intuitive? How much would taxpayers like to be able to self-serve? Should the tax system be somewhat like a smartphone, in that something which is easy to use can have a complex interior, or is it the case that no tax system with a complex ‘interior’ can ever be simple?

One of the deeper questions is the balance of effort between simplifying the legislation and improving the ‘user experience’. Clearly, the two are inextricably linked as mystifying legislation is unlikely to translate into an effortless user experience. But the question remains as to where the greater part of the effort might produce the most worthwhile results.

The growing quantity of legislation has been a concern for many years. On 25 February 2003, the House of Lords debated the Income Tax (Earnings and Pensions) Bill. Lord Saatchi said, in connection with the tax law rewrite project, that: ‘The then chancellor, Mr Clarke, summed up the ambition of the project in his Budget speech. He famously said that it would be “like translating the whole of War and Peace into lucid Swahili”. My noble and learned friend Lord Howe added that it was “like trying to repaint Brighton pier at a time when its owners are trying to extend it to the French coast”.’ By 2017, applying the latter analogy, we might consider the Brighton pier to have reached the northern coast of the Mediterranean Sea. We have no reason to believe that the body of tax legislation will be reduced anytime soon to one volume of direct and one volume of indirect taxes, as was the case in the early 1980s. We therefore feel that energy directed to the experience of ordinary people (i.e. not tax professionals!) in interacting with the tax system would be at least as well spent as further work on the legislation itself. However, we welcome views on this question.

Our work will reflect some constraints on what is achievable in the short term. Clearly, HMRC, in common with all government departments, will have to devote a considerable amount of time to preparing for Brexit. HMRC is also focused on making tax digital, and this will occupy many of the in-house technology experts, and others, over the next few years. We are also conscious of the need to maintain revenues, although we will not limit our recommendations to those which secure revenue neutrality where there is an overriding simplification benefit.

Our short-term plans include publishing our reports on paper stamp duty, simplifying the corporation tax computation and our first annual report, as well as the updated focus paper on the gig economy and a paper on lessons learned. We will continue to work on our report on VAT, which is due out in the autumn. We then plan to turn to the business life cycle, from starting a business, taking on the first employee, making the first cross-border sale, raising capital and passing on a business to the next generation. We may also look further at relief for capital expenditure.

Other possible ideas on the ‘long list’ include thresholds, definitions and terminology, savings products including ISAs and insurance products, the Complexity Index, reliefs for R&D, share schemes, pensions, rulings and clearances, double tax relief for individuals, short term business visitors, transfer pricing, boundary aspects of devolution, further work on tax reliefs, education, capital gains tax, inheritance tax and foreign income for individuals. This ‘long list’ will have to be translated into a ‘shorter’ list, as we cannot address all of these areas at the same time.

We warmly welcome suggestions and contributions from everyone in the tax community and, indeed, the wider public. Readers of Tax Journal will undoubtedly see specific aspects of the tax system which could be simplified. All ideas are welcome. Please contact us at ots@ots.gsi.gov.uk. We also appreciate offers to work with us on particular projects or to join one of our consultative committees. Indeed, we are always interested in hearing from people who might like to come to work with us. Our team includes secondees from HMRC and HM Treasury, as well as full or part-time team members with private sector experience in business or large or small professional firms or in the law.

The practice of the OTS, under John Whiting’s open and listening leadership, has been to ensure that no one can ever say they have not had an opportunity to share their views with the OTS team, and we intend to continue this tradition! It is the day to day experience of taxpayers and their advisers which will provide the best insights into where the system is not functioning as well as it might. For example, an individual explained how he was trying to claim a tax relief to which he was certainly entitled, yet abandoned the effort part way through because he was not able to understand the questions he was required to answer. In another example, a form received by a charity was really quite hard to understand without further explanation. At the other end of the spectrum, there are examples of legislation which even the most learned tax professional advisers are struggling to interpret.

We have a full work programme and a dedicated, talented and enthusiastic team and we benefit from huge amounts of help and support from stakeholders, including professional advisers, members of the public, HMRC, HM Treasury and, not least, readers of Tax Journal. The ‘road to simplification’ is not straightforward but we walk forward among friends.

With the potential for an enormous agenda, including work requested by the chancellor as well as our own initiatives, at the Office of Tax Simplification, we have to be thoughtful about how we prioritise. In order to benefit taxpayers as widely as possible, we plan to look in a broad way at the ‘user experience’ of those interacting with the tax system, and to examine the impact of tax at points in the life cycles of businesses and at key points in the lives of individual taxpayers. We are keen to hear from Tax Journal readers as we develop our plans for the next 12 months, one to three years and beyond (at ots@ots.gsi.gov.uk).

Why simplify tax? After all, UK taxpayers have access to one of the world’s finest tax professional communities and HMRC provides as much guidance as any other tax administration, if not more. There is a tradition in the UK of making specific provision for a wide range of circumstances in the interest of fairness and consistency. What is comprehensive in a complex world is unavoidably voluminous. There may even be some who rather enjoy delving into the intricacies of our labyrinthine tax system!

On the other hand, strictly applying the principle of ‘ignorance of the law is no excuse’ to some 20 million words of tax legislation would be somewhat heroic. So, on a practical level, it is clearly essential that individuals and those running businesses are able to understand their tax obligations and liabilities. The outcome should be certain, clear and intuitively reasonable.

Business owners should be able to focus their energy on running their business, rather than grappling with the tax system. It is as important for productivity as it is for the competitiveness of the UK in attracting inbound trade and investment.

These objectives – certainty, clarity, results that are intuitively reasonable for individuals and productivity and competitiveness for business – provide the basis on which we will prioritise our work. We will look to make a positive difference for the greatest number of people on the greatest number of occasions. This means that aspects of the tax system which affect people generally or which impact on small businesses will be a particular priority. Measures which improve the experience of those interacting with the tax system will be just as important, if not more so, than technical simplifications and changes in the underlying legislative structure.

Where there is an opportunity to secure a ‘quick win’, we will point to that. There will also be other cases where there is no quick win and where the number affected may be small but it is simply ‘the right thing to do’. An example of the latter would be paper stamp duty, where there is an opportunity to modernise some quaint but rather antiquated practices! At the core of our work, however, we will focus on the ‘user experience’ for the majority of taxpayers.

There is enormous support for tax simplification. In his inaugural speech as president of the CIOT, John Preston emphasised ‘the unquestionable need to simplify the UK tax system’. The Conservative Party manifesto recognised that: ‘A good tax system is not just about the headline rates of tax, however, but about its simplicity. Our system remains too complicated, making it hard for people – especially self-employed people and small businesses – to assess their taxes.’

The Office of Tax Simplification (OTS) is now formally established under FA 2016 Part 12. Section 184 provides for continuation of the OTS, initially created in 2010 on a less formal basis. This came into effect on 28 November 2016 under The Finance Act 2016, Sections 184 to 188 and Schedule 25 (Commencement) Regulations, SI 2016/1133, which might prompt the thought that legislating for the continuation of the OTS was, perhaps, not so simple after all.

Section 185 provides that the OTS must provide advice to the chancellor, on request or as the OTS considers appropriate, on the simplification of the tax system, which, under s 185(3), includes improving the efficiency of its administration. The scope of the OTS extends to all taxes collected or managed by HMRC, including duties and NICs. Where a review is requested by the chancellor, the report is published and laid before Parliament.

Our recent publications include our interim report on VAT and our focus paper on complexity, published in February, and our further papers on complexity published in March, including the complexity index. The focus paper on complexity considered the length of legislation, thresholds, whether layered legislation could offer a different approach, definitions and some general principles on avoiding complexity in the tax system.

We identified four principles for avoiding complexity: policymakers should ensure the proposed tax measure meets the policy aims; focus the measure carefully; design the measure to meet the aim; and maintain the measure properly.

In January, the CIOT, Institute for Fiscal Studies and Institute for Government published their Better Budgets report, which outlined ten steps towards making better tax policy. The recommendations included publishing clear guiding principles and priorities for tax policy, improving consultation and the opening up of public debate. We hope that our focus papers will continue to contribute to, and inform, this public debate.

Also in March, we published our interim report on stamp duty on paper transactions and we will shortly be publishing a report pointing the way forward in modernising the UK’s oldest remaining tax.

The tax system needs to adapt to an increasingly digital economy, a world in which work takes an ever wider range of shapes from traditional employment, to all kinds of independent working and the ‘gig economy’. The ‘sharing’ economy provides new challenges for the tax system as assets can be monetised in a variety of ways. Big data analytics, robotics, artificial intelligence, distributed ledgers (block chain), bitcoin and other technology developments pose further challenges. We will be exploring ways in which we can use technology to make tax simpler, as well as ways in which it is hard to stop technology making tax more complex or uncertain.

We will be asking questions about attitudes to tax simplification. For example, would taxpayers be prepared to pay marginally more tax in some situations if the outcome was more simple and intuitive? How much would taxpayers like to be able to self-serve? Should the tax system be somewhat like a smartphone, in that something which is easy to use can have a complex interior, or is it the case that no tax system with a complex ‘interior’ can ever be simple?

One of the deeper questions is the balance of effort between simplifying the legislation and improving the ‘user experience’. Clearly, the two are inextricably linked as mystifying legislation is unlikely to translate into an effortless user experience. But the question remains as to where the greater part of the effort might produce the most worthwhile results.

The growing quantity of legislation has been a concern for many years. On 25 February 2003, the House of Lords debated the Income Tax (Earnings and Pensions) Bill. Lord Saatchi said, in connection with the tax law rewrite project, that: ‘The then chancellor, Mr Clarke, summed up the ambition of the project in his Budget speech. He famously said that it would be “like translating the whole of War and Peace into lucid Swahili”. My noble and learned friend Lord Howe added that it was “like trying to repaint Brighton pier at a time when its owners are trying to extend it to the French coast”.’ By 2017, applying the latter analogy, we might consider the Brighton pier to have reached the northern coast of the Mediterranean Sea. We have no reason to believe that the body of tax legislation will be reduced anytime soon to one volume of direct and one volume of indirect taxes, as was the case in the early 1980s. We therefore feel that energy directed to the experience of ordinary people (i.e. not tax professionals!) in interacting with the tax system would be at least as well spent as further work on the legislation itself. However, we welcome views on this question.

Our work will reflect some constraints on what is achievable in the short term. Clearly, HMRC, in common with all government departments, will have to devote a considerable amount of time to preparing for Brexit. HMRC is also focused on making tax digital, and this will occupy many of the in-house technology experts, and others, over the next few years. We are also conscious of the need to maintain revenues, although we will not limit our recommendations to those which secure revenue neutrality where there is an overriding simplification benefit.

Our short-term plans include publishing our reports on paper stamp duty, simplifying the corporation tax computation and our first annual report, as well as the updated focus paper on the gig economy and a paper on lessons learned. We will continue to work on our report on VAT, which is due out in the autumn. We then plan to turn to the business life cycle, from starting a business, taking on the first employee, making the first cross-border sale, raising capital and passing on a business to the next generation. We may also look further at relief for capital expenditure.

Other possible ideas on the ‘long list’ include thresholds, definitions and terminology, savings products including ISAs and insurance products, the Complexity Index, reliefs for R&D, share schemes, pensions, rulings and clearances, double tax relief for individuals, short term business visitors, transfer pricing, boundary aspects of devolution, further work on tax reliefs, education, capital gains tax, inheritance tax and foreign income for individuals. This ‘long list’ will have to be translated into a ‘shorter’ list, as we cannot address all of these areas at the same time.

We warmly welcome suggestions and contributions from everyone in the tax community and, indeed, the wider public. Readers of Tax Journal will undoubtedly see specific aspects of the tax system which could be simplified. All ideas are welcome. Please contact us at ots@ots.gsi.gov.uk. We also appreciate offers to work with us on particular projects or to join one of our consultative committees. Indeed, we are always interested in hearing from people who might like to come to work with us. Our team includes secondees from HMRC and HM Treasury, as well as full or part-time team members with private sector experience in business or large or small professional firms or in the law.

The practice of the OTS, under John Whiting’s open and listening leadership, has been to ensure that no one can ever say they have not had an opportunity to share their views with the OTS team, and we intend to continue this tradition! It is the day to day experience of taxpayers and their advisers which will provide the best insights into where the system is not functioning as well as it might. For example, an individual explained how he was trying to claim a tax relief to which he was certainly entitled, yet abandoned the effort part way through because he was not able to understand the questions he was required to answer. In another example, a form received by a charity was really quite hard to understand without further explanation. At the other end of the spectrum, there are examples of legislation which even the most learned tax professional advisers are struggling to interpret.

We have a full work programme and a dedicated, talented and enthusiastic team and we benefit from huge amounts of help and support from stakeholders, including professional advisers, members of the public, HMRC, HM Treasury and, not least, readers of Tax Journal. The ‘road to simplification’ is not straightforward but we walk forward among friends.