Whoever wins the general election on 8 June, tax revenues are set to rise to their highest share of national income in over 30 years. There is a stark difference between the Conservative and Labour party not only in how much tax receipts will rise, but also in who would pay. On income tax, the Conservatives would continue to raise the personal allowance, taking it to £12,500 by 2020, and would increase the higher rate threshold above inflation, whereas both Labour and the Lib Dems propose to raise substantial revenue through increasing income tax. Corporation tax is one area offering the sharpest contrast between the two main parties: the Conservatives would continue with their plans to cut the rate from 19% to 17%, whereas Labour would impose staged increases in the main rate to 26%. The Lib Dems would choose a middle path, increasing the rate to 20%. All political parties say they would take further steps to tackle avoidance. None of the manifestos set out a strategy for the taxation of the banking sector, or the taxation of different ways of working. If recent decades are any guide, then regardless of who wins we can expect further tax-raising measures announced after the election, including those not featuring in the winning party’s general election manifesto.

Taxes are going up after 8 June. The question is which taxes and by how much.

The Conservatives put forward a ‘steady as she goes’ manifesto, with plans that are almost indistinguishable from the March budget. But, there are already planned tax rises on the books, including increases in dividend tax and council tax. The Office for Budget Responsibility’s March forecast shows that tax receipts are due to reach the highest share of national income since the early 1980s.

In sharp contrast, Labour has a long list of policies aimed at increasing taxes on high earners and businesses. If enacted, tax receipts would likely increase to their highest share of national income since the 1950s. The Liberal Democrats are somewhere in between: higher taxes than the Conservatives but not as high as Labour.

There are some areas of agreement. Labour and the Liberal Democrats are united in their desire to reverse Conservative cuts to capital gains tax, income tax (through the marriage allowance) and inheritance tax. All three parties say they would launch a(nother) review of business rates. All want to crack down further on avoidance and all propose changes to income tax (albeit with different ideas about the particulars).

The Conservatives would fulfil their pledge, first set out in the run up to the 2015 election, to raise the personal allowance to £12,500 by 2020. This is actually now very easy to do because the personal allowance is already set to increase to £12,300 in 2020/21 as a result of normal uprating of thresholds in line with inflation. Above inflation increases in the personal allowance will continue the trend of taking people out of income tax altogether; in 2015/16, 43% of adults paid no income tax, up from 39% in 2010/11. The Conservatives would also increase the higher rate threshold above inflation. This would be a giveaway to the 15% of income taxpayers that are subject to the higher rate.

In contrast, both Labour and the Lib Dems propose to raise substantial revenue through increasing income tax. Labour proposes to increase income tax for the 1.3m people with taxable income exceeding £80,000 per year. Specifically, they would introduce a 45% income tax rate on incomes over £80,000, and a 50% rate on incomes over £123,000 (see figure 1 below). Those earning above £80,000 represent 4% of income taxpayers and just 2% of adults (because not all adults pay tax). Currently, this small group of people receive more than 20% of all taxable income and pay more than 40% of all income tax. Our income tax system is, therefore, already quite top heavy.

Labour expects these policies to bring in an extra £4.5bn per year. Based on the available evidence, this looks on the optimistic side. We would expect those people affected to respond by reducing their taxable incomes. This could occur through a number of channels, including reducing work hours or effort, increasing private pension contributions, making greater efforts to avoid or evade tax or emigrating. The middle of a plausible range of estimates for the revenue raised by Labour’s policy is £2.5bn per year. It is entirely possible that the policy would bring in £4.5bn if high earners are less responsive than past evidence suggests. However, it is also possible that the policy would raise nothing if this group is more responsive.

One thing that clearly stands out from figure 1 is the ridiculous hump at £100,000, which arises from the withdrawal of the personal allowance. It is unfortunate that a plan for a large change to the income tax system is not accompanied by a plan to make the schedule more sensible.

The Liberal Democrats propose raising all rates of income tax by one percentage point. This would be a very broad-based, but relatively modest per person, change that would raise around £6bn per year. There is considerably more certainty around the revenue raised by this policy relative to Labour’s because it is far less dependent on a small group at the very top.

This difficulty of getting more income tax out of high earners may pose a dilemma for those policy makers who wish to see the rich pay more. Even assuming that we could collect substantially more income tax from the top, we must also be aware that our increasing reliance on a small group can leave us exposed. Regardless of one’s view of income inequality, or the share of total income that accrues to high-earning bankers, well-paid chief executives and the like, if top taxpayers experience weak earnings growth or decide to move elsewhere – and many of them were not born in the UK – then the rest of us will have to pick up a very big bill.

Of course, income tax isn’t the only game in town. We currently tax dividends and capital gains more lightly than earned income and our woefully out of date council tax system favours those who live in more expensive houses (council tax is based on 1991 values and is higher as a share of property value for lower value properties). These features of the tax system predominately benefit better off households. There are, therefore, other ways to raise money from ‘the rich’. But this also highlights that when a politician or journalist talks about ‘the rich’, we should always ask who they mean.

The proposed path of corporation tax is one of the starkest differences between the two main parties. The Conservatives would crack on with their plans to cut the rate from 19% to 17% at an annual cost of £5.4bn. Labour would seek to raise an additional £19.4bn (relative to a rate of 17%) through staged increases in the main rate to 26% (figure 2 below). This would be the first time the UK’s main rate of the modern corporation tax had been increased. A small profits rate – a preferential rate for companies with low profits – would be reintroduced and rise to 21%. The Lib Dems would choose a middle path, increasing the rate to 20%.

There is no ‘right answer’ to the question of what the corporation tax rate should be. There are trade-offs. On the one hand, increases in corporation tax can raise substantial sums. This is revenue that can be spent on projects that boost the economic potential of the country. Labour, for example, would spend the additional revenue on education. On the other hand, we would expect firms to respond to higher rates by investing less in the UK. This in turn would depress economic activity and lead to fewer jobs and lower wages. It would also mean that Labour’s policy would raise less revenue in the medium to long run. There is a very high degree of uncertainty about how large these effects are but estimates suggest that they may be substantial. The potential size of these effects is a key reason why the OECD and others judge corporation tax to have a particularly damaging effect on economic growth.

The UK’s rate has been cut substantially since 2010, such that even a 7 percentage point increase from today would leave us with the lowest rate in the G7. We would return to the 2011 rate; hardly unchartered territory. However, some firms would still face a higher tax bill under Labour’s plans than in 2010. Other measures introduced since then, including reductions in capital allowances and restrictions on interest deductibility, act to increase the effective tax rates faced by some firms. Banks’ profits are now subject to an 8% surcharge. They would therefore face effective headline rates of 25%, 34% or 28% under Conservative, Labour or Lib Dem policies respectively.

A reintroduced small profits rate – and the marginal relief that it would entail – would be an unfortunate side effect of the Labour plan. There is little compelling evidence that a lower rate for low profit companies encourages entrepreneurship and the redistributional motivation for a progressive personal income tax system simply does not apply to firms. A new small profits rate would reintroduce unnecessary and unwelcome complexity into the corporation tax system.

All three parties say that they would take further steps to tackle avoidance. The Conservatives propose a ‘more proactive approach to transparency and misuse of trusts’ but give no details. The Lib Dems go a little further by proposing a general anti-avoidance rule and a target for HMRC to close the tax gap. They would also like a consultation on moving away from a profit-based tax altogether.

Labour set out a long list of policies from which they would seek to raise almost £9bn. It is almost always very difficult to assess how much anti-avoidance policies will raise because it is difficult to predict how firms will change their behaviour. However, Labour’s announced policies will not raise £9bn. Adjusting for a £2.5bn factual error and taking more reasonable central estimates where available suggests the revenue forecast should be closer to £4.5bn. Even this is on the optimistic side, not least because not all policy ideas are backed by a plan of how to deliver them.

Labour’s package of ideas includes some measures aimed at closing specific loopholes (for example the ‘mayfair tax’ loophole) alongside mechanisms to boost transparency (for example through public filing of companies’ and wealthy individuals’ tax returns and registers of beneficial owners). Some of Labour’s ideas highlight why we can expect discussions about avoidance to be on the agenda for the foreseeable future: there is clearly no agreement about what counts as avoidance. One proposal is to prevent tax avoiders from being awarded government contracts. Of course, tax avoidance is, by definition, legal. Presumably, therefore, implementing such a policy would mean excluding from contracts firms who had been deemed to be tax compliant by HMRC, but deemed not compliant enough by some other part of government. This seems bizarre. One could perhaps make the policy more rational by excluding firms who have fallen foul of anti-avoidance rules in the past. A superior approach would be to focus on working out what we want to tax and writing tax laws to achieve that aim as best as possible.

Since 2010 there have been a number of attempts to get more money out of the banking sector. The most commonly cited aim is that the banking sector should help pay for the public finance cost of the crisis. Another oft-cited aim is that taxes should be used to make banking less risky. What has resulted is a hodgepodge of ever changing policies that are only loosely related to these aims.

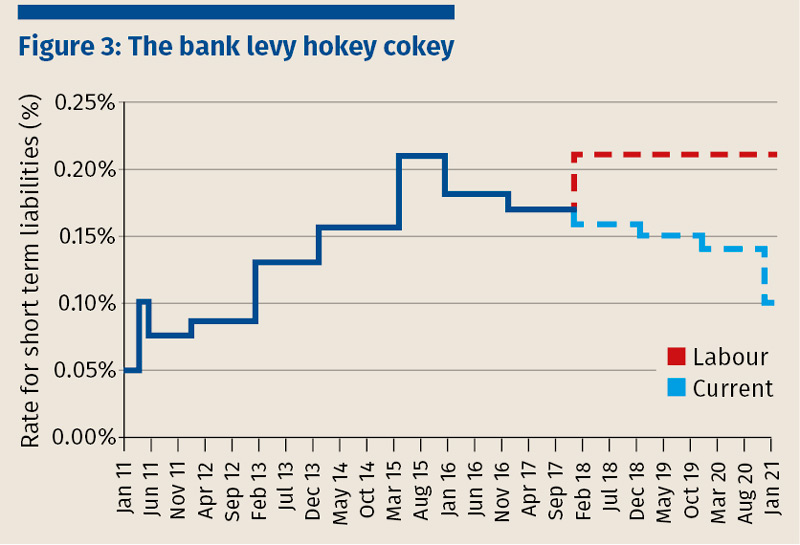

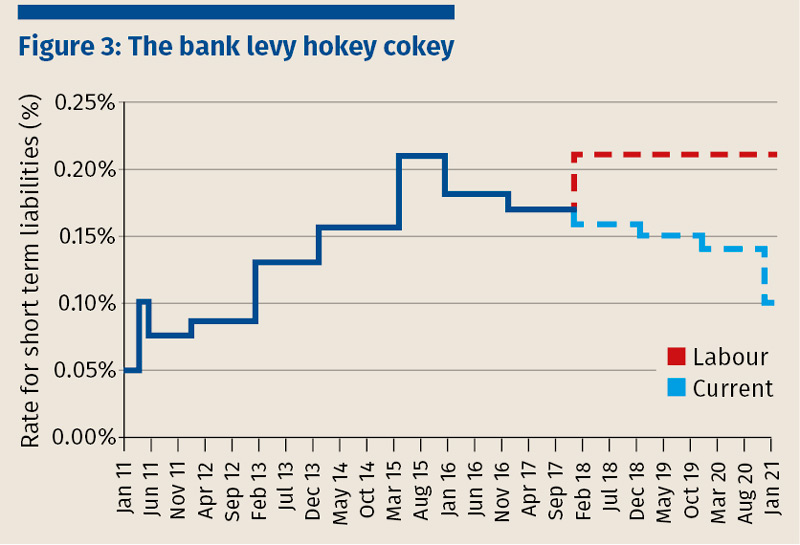

At present, banks are subject to the bank levy (a tax on the liabilities on large banks’ balance sheets), an 8 percentage point surcharge on the rate of corporation tax and a 25% restriction on the proportion of taxable profit that can be offset by carrying forward losses from previous years. The bank levy was consistently ratcheted up after its introduction in 2011 in pursuit of a revenue target (see figure 3 below). The revenue target was always bizarre because it implied that the more effective the levy was in reducing banks’ risky borrowing, the higher the tax rate would be. The rate has been subject to staged cuts since 2016 following concerns about how it was affecting banks’ decisions, including over whether some banks would remain headquartered in the UK. The Labour party would reverse the cuts.

Measures introduced since 2010 have buoyed revenue from the financial sector, which would otherwise have fallen substantially because of a lower corporation tax rate combined with weak profits and large losses in the wake of the financial recession. But we now have a system of bank taxation that is substantially more complicated than before the crisis and one that is not underpinned by a clear strategy. It is ambiguous as to whether the bank levy succeeds in reducing the overall riskiness of banks’ balance sheets: banks may simply shift risk within their portfolios. The bank surcharge does raise revenue, but it raises most from the most profitable banks, which are not necessarily those that were most involved in the crisis or that pose the largest systemic risk at present. Whoever wins the next election, more thought should be given to whether, and if so how, the banking sector should be taxed differently from other sectors.

If Labour wins, they would extend the stamp duty reserve tax. SDRT is currently levied at a rate of 0.5% on the purchase price of shares, with an exemption when shares are purchased by an intermediary. Labour proposes to raise £6.5bn by extending the tax to bonds and derivatives and removing the intermediaries’ exemption. The latter is a terrible idea. It implies, for example, that shares would be taxed once if bought directly and twice if bought through a broker. More broadly, taxes on transactions are some of the worst types of taxes. They act to prevent mutually beneficial trades. Arguably, therefore, Labour’s proposal would extend a bad tax.

The best-case argument for a transaction tax on financial products rests on its ability to reduce high-frequency, speculative trading. The concern is that such trading adds volatility to financial markets, thereby masking the price signals that are driven by investment fundamentals. This in turn distorts the allocation of investment and increases risk. A transaction tax throws ‘sand in the wheels’ and reduces volatility. However, the evidence on whether this works in practice is mixed. Taxes that reduce trading may in fact increase volatility by reducing liquidity in the market. In addition, any benefits must be weighed against the costs associated with an increased cost of external finance for UK firms (since SDRT depresses share prices), which acts to reduce investment.

Generously, the jury is out on whether transaction taxes in financial markets are a good idea. Assuming they are, there is some logic to extending the tax to derivatives. However, in practice, it will be difficult to define derivatives broadly enough to ensure that firms cannot simply design a form of financial derivative that escapes the new tax.

Labour, and others, refer to this policy as the Robin Hood tax. This is highly misleading. It gives the impression that the tax is raised from rich people. It is not, at least not entirely. Extension of SDLT will directly reduce the investment returns to all of those that invest in derivatives and bonds (including indirectly through a pension). To the extent that it leads to lower investment by UK firms, it is also likely to have indirect effects on wages and prices. SDLT should not be seen simply as a tax on the owners or employees of financial sector firms.

None of the parties set out whether, and if so how, they would deal with the public finance hole that is growing as more people choose to work for their own business. It is now widely known that the self-employed and company owner-managers are taxed at lower rates than employees. These groups have accounted for 40% of the workforce growth since 2008 and by 2020/21 the continuation of that growth will cost the exchequer £4.5bn.

The Conservatives, having been burned by Phillip Hammond’s failed attempt to make a minor dent in the problem by increasing class 4 NICs, don’t say what they would do. But, the chancellor clearly set out in his u-turn speech that he still judges the scale of the NICs difference between employees and the self-employed to be a problem and ‘continues to believe that’ reducing the tax difference ‘is the right approach’. The manifesto has dropped the so-called ‘tax lock’, which is sensible because it allows the freedom to respond to unexpected events. This leaves open the possibility that a Conservative government post 8 June would try again to increase self-employed NICs, possibly alongside increased parental rights and revamped employment laws.

Labour have ruled out increases in NICs so would find it very difficult to level the playing field between employees and the self-employed.

Labour have set out a vision for a larger state, albeit one that would be more Canadian than Scandinavian in scale. They propose to pay for this by asking ‘the rich’ and companies to pay ‘a little more’. To start, £50bn is not a little more: it would represent a 6% increase in the total tax take. More importantly, they have made much of the idea that 95% of people won’t pay more tax. But this pledge applies only to the direct effect of their income tax policies. It is fanciful to think that the additional £50bn that they are seeking to raise would come solely from the top 5%. Instead, additional taxes on businesses would at least lead to lower returns to savers, including the millions of people that are indirectly shareholders through their private pensions. We’d also expect higher taxes to feed through into lower wages and higher prices. There is a choice we can make as a country to have a bigger state. That would not make us unusual in international terms. But we should be under no illusion that ‘someone else’ will be paying: we would all be chipping in.

On the face of it, the Conservatives are not proposing any new tax increases. However, they have set themselves the target of reaching a balanced budget by the middle of the next decade. To achieve this they would need to find further spending cuts (on top of the seven years of austerity we’ve just had and the five years pencilled in) or raise taxes. This choice would be made against the backdrop of an aging population and growing cost of healthcare which mean that the government would need to increase spending simply to maintain current service levels. The clear risk is that the Conservatives would not be able to deliver the promised spending cuts without serious damage to the quality of public services. It’s highly unlikely that we can have no tax increases, the same quality public services and a balanced budget; something is probably going to have to give.

Whoever wins on 8 June, in coming years we all face a choice about the size of the state and how it’s paid for. My guess is that taxes will rise regardless of who wins the election. That’s an evidence based guess. In the 12 months following the last six general elections (1992, 1997, 2001, 2005, 2010 and 2015), significant tax-raising measures were announced, despite these measures typically not featuring in the winning party’s general election manifesto. So, as the next 12 months progress, I’ll be watching out for the tax policies that weren’t in the manifestos.

Whoever wins the general election on 8 June, tax revenues are set to rise to their highest share of national income in over 30 years. There is a stark difference between the Conservative and Labour party not only in how much tax receipts will rise, but also in who would pay. On income tax, the Conservatives would continue to raise the personal allowance, taking it to £12,500 by 2020, and would increase the higher rate threshold above inflation, whereas both Labour and the Lib Dems propose to raise substantial revenue through increasing income tax. Corporation tax is one area offering the sharpest contrast between the two main parties: the Conservatives would continue with their plans to cut the rate from 19% to 17%, whereas Labour would impose staged increases in the main rate to 26%. The Lib Dems would choose a middle path, increasing the rate to 20%. All political parties say they would take further steps to tackle avoidance. None of the manifestos set out a strategy for the taxation of the banking sector, or the taxation of different ways of working. If recent decades are any guide, then regardless of who wins we can expect further tax-raising measures announced after the election, including those not featuring in the winning party’s general election manifesto.

Taxes are going up after 8 June. The question is which taxes and by how much.

The Conservatives put forward a ‘steady as she goes’ manifesto, with plans that are almost indistinguishable from the March budget. But, there are already planned tax rises on the books, including increases in dividend tax and council tax. The Office for Budget Responsibility’s March forecast shows that tax receipts are due to reach the highest share of national income since the early 1980s.

In sharp contrast, Labour has a long list of policies aimed at increasing taxes on high earners and businesses. If enacted, tax receipts would likely increase to their highest share of national income since the 1950s. The Liberal Democrats are somewhere in between: higher taxes than the Conservatives but not as high as Labour.

There are some areas of agreement. Labour and the Liberal Democrats are united in their desire to reverse Conservative cuts to capital gains tax, income tax (through the marriage allowance) and inheritance tax. All three parties say they would launch a(nother) review of business rates. All want to crack down further on avoidance and all propose changes to income tax (albeit with different ideas about the particulars).

The Conservatives would fulfil their pledge, first set out in the run up to the 2015 election, to raise the personal allowance to £12,500 by 2020. This is actually now very easy to do because the personal allowance is already set to increase to £12,300 in 2020/21 as a result of normal uprating of thresholds in line with inflation. Above inflation increases in the personal allowance will continue the trend of taking people out of income tax altogether; in 2015/16, 43% of adults paid no income tax, up from 39% in 2010/11. The Conservatives would also increase the higher rate threshold above inflation. This would be a giveaway to the 15% of income taxpayers that are subject to the higher rate.

In contrast, both Labour and the Lib Dems propose to raise substantial revenue through increasing income tax. Labour proposes to increase income tax for the 1.3m people with taxable income exceeding £80,000 per year. Specifically, they would introduce a 45% income tax rate on incomes over £80,000, and a 50% rate on incomes over £123,000 (see figure 1 below). Those earning above £80,000 represent 4% of income taxpayers and just 2% of adults (because not all adults pay tax). Currently, this small group of people receive more than 20% of all taxable income and pay more than 40% of all income tax. Our income tax system is, therefore, already quite top heavy.

Labour expects these policies to bring in an extra £4.5bn per year. Based on the available evidence, this looks on the optimistic side. We would expect those people affected to respond by reducing their taxable incomes. This could occur through a number of channels, including reducing work hours or effort, increasing private pension contributions, making greater efforts to avoid or evade tax or emigrating. The middle of a plausible range of estimates for the revenue raised by Labour’s policy is £2.5bn per year. It is entirely possible that the policy would bring in £4.5bn if high earners are less responsive than past evidence suggests. However, it is also possible that the policy would raise nothing if this group is more responsive.

One thing that clearly stands out from figure 1 is the ridiculous hump at £100,000, which arises from the withdrawal of the personal allowance. It is unfortunate that a plan for a large change to the income tax system is not accompanied by a plan to make the schedule more sensible.

The Liberal Democrats propose raising all rates of income tax by one percentage point. This would be a very broad-based, but relatively modest per person, change that would raise around £6bn per year. There is considerably more certainty around the revenue raised by this policy relative to Labour’s because it is far less dependent on a small group at the very top.

This difficulty of getting more income tax out of high earners may pose a dilemma for those policy makers who wish to see the rich pay more. Even assuming that we could collect substantially more income tax from the top, we must also be aware that our increasing reliance on a small group can leave us exposed. Regardless of one’s view of income inequality, or the share of total income that accrues to high-earning bankers, well-paid chief executives and the like, if top taxpayers experience weak earnings growth or decide to move elsewhere – and many of them were not born in the UK – then the rest of us will have to pick up a very big bill.

Of course, income tax isn’t the only game in town. We currently tax dividends and capital gains more lightly than earned income and our woefully out of date council tax system favours those who live in more expensive houses (council tax is based on 1991 values and is higher as a share of property value for lower value properties). These features of the tax system predominately benefit better off households. There are, therefore, other ways to raise money from ‘the rich’. But this also highlights that when a politician or journalist talks about ‘the rich’, we should always ask who they mean.

The proposed path of corporation tax is one of the starkest differences between the two main parties. The Conservatives would crack on with their plans to cut the rate from 19% to 17% at an annual cost of £5.4bn. Labour would seek to raise an additional £19.4bn (relative to a rate of 17%) through staged increases in the main rate to 26% (figure 2 below). This would be the first time the UK’s main rate of the modern corporation tax had been increased. A small profits rate – a preferential rate for companies with low profits – would be reintroduced and rise to 21%. The Lib Dems would choose a middle path, increasing the rate to 20%.

There is no ‘right answer’ to the question of what the corporation tax rate should be. There are trade-offs. On the one hand, increases in corporation tax can raise substantial sums. This is revenue that can be spent on projects that boost the economic potential of the country. Labour, for example, would spend the additional revenue on education. On the other hand, we would expect firms to respond to higher rates by investing less in the UK. This in turn would depress economic activity and lead to fewer jobs and lower wages. It would also mean that Labour’s policy would raise less revenue in the medium to long run. There is a very high degree of uncertainty about how large these effects are but estimates suggest that they may be substantial. The potential size of these effects is a key reason why the OECD and others judge corporation tax to have a particularly damaging effect on economic growth.

The UK’s rate has been cut substantially since 2010, such that even a 7 percentage point increase from today would leave us with the lowest rate in the G7. We would return to the 2011 rate; hardly unchartered territory. However, some firms would still face a higher tax bill under Labour’s plans than in 2010. Other measures introduced since then, including reductions in capital allowances and restrictions on interest deductibility, act to increase the effective tax rates faced by some firms. Banks’ profits are now subject to an 8% surcharge. They would therefore face effective headline rates of 25%, 34% or 28% under Conservative, Labour or Lib Dem policies respectively.

A reintroduced small profits rate – and the marginal relief that it would entail – would be an unfortunate side effect of the Labour plan. There is little compelling evidence that a lower rate for low profit companies encourages entrepreneurship and the redistributional motivation for a progressive personal income tax system simply does not apply to firms. A new small profits rate would reintroduce unnecessary and unwelcome complexity into the corporation tax system.

All three parties say that they would take further steps to tackle avoidance. The Conservatives propose a ‘more proactive approach to transparency and misuse of trusts’ but give no details. The Lib Dems go a little further by proposing a general anti-avoidance rule and a target for HMRC to close the tax gap. They would also like a consultation on moving away from a profit-based tax altogether.

Labour set out a long list of policies from which they would seek to raise almost £9bn. It is almost always very difficult to assess how much anti-avoidance policies will raise because it is difficult to predict how firms will change their behaviour. However, Labour’s announced policies will not raise £9bn. Adjusting for a £2.5bn factual error and taking more reasonable central estimates where available suggests the revenue forecast should be closer to £4.5bn. Even this is on the optimistic side, not least because not all policy ideas are backed by a plan of how to deliver them.

Labour’s package of ideas includes some measures aimed at closing specific loopholes (for example the ‘mayfair tax’ loophole) alongside mechanisms to boost transparency (for example through public filing of companies’ and wealthy individuals’ tax returns and registers of beneficial owners). Some of Labour’s ideas highlight why we can expect discussions about avoidance to be on the agenda for the foreseeable future: there is clearly no agreement about what counts as avoidance. One proposal is to prevent tax avoiders from being awarded government contracts. Of course, tax avoidance is, by definition, legal. Presumably, therefore, implementing such a policy would mean excluding from contracts firms who had been deemed to be tax compliant by HMRC, but deemed not compliant enough by some other part of government. This seems bizarre. One could perhaps make the policy more rational by excluding firms who have fallen foul of anti-avoidance rules in the past. A superior approach would be to focus on working out what we want to tax and writing tax laws to achieve that aim as best as possible.

Since 2010 there have been a number of attempts to get more money out of the banking sector. The most commonly cited aim is that the banking sector should help pay for the public finance cost of the crisis. Another oft-cited aim is that taxes should be used to make banking less risky. What has resulted is a hodgepodge of ever changing policies that are only loosely related to these aims.

At present, banks are subject to the bank levy (a tax on the liabilities on large banks’ balance sheets), an 8 percentage point surcharge on the rate of corporation tax and a 25% restriction on the proportion of taxable profit that can be offset by carrying forward losses from previous years. The bank levy was consistently ratcheted up after its introduction in 2011 in pursuit of a revenue target (see figure 3 below). The revenue target was always bizarre because it implied that the more effective the levy was in reducing banks’ risky borrowing, the higher the tax rate would be. The rate has been subject to staged cuts since 2016 following concerns about how it was affecting banks’ decisions, including over whether some banks would remain headquartered in the UK. The Labour party would reverse the cuts.

Measures introduced since 2010 have buoyed revenue from the financial sector, which would otherwise have fallen substantially because of a lower corporation tax rate combined with weak profits and large losses in the wake of the financial recession. But we now have a system of bank taxation that is substantially more complicated than before the crisis and one that is not underpinned by a clear strategy. It is ambiguous as to whether the bank levy succeeds in reducing the overall riskiness of banks’ balance sheets: banks may simply shift risk within their portfolios. The bank surcharge does raise revenue, but it raises most from the most profitable banks, which are not necessarily those that were most involved in the crisis or that pose the largest systemic risk at present. Whoever wins the next election, more thought should be given to whether, and if so how, the banking sector should be taxed differently from other sectors.

If Labour wins, they would extend the stamp duty reserve tax. SDRT is currently levied at a rate of 0.5% on the purchase price of shares, with an exemption when shares are purchased by an intermediary. Labour proposes to raise £6.5bn by extending the tax to bonds and derivatives and removing the intermediaries’ exemption. The latter is a terrible idea. It implies, for example, that shares would be taxed once if bought directly and twice if bought through a broker. More broadly, taxes on transactions are some of the worst types of taxes. They act to prevent mutually beneficial trades. Arguably, therefore, Labour’s proposal would extend a bad tax.

The best-case argument for a transaction tax on financial products rests on its ability to reduce high-frequency, speculative trading. The concern is that such trading adds volatility to financial markets, thereby masking the price signals that are driven by investment fundamentals. This in turn distorts the allocation of investment and increases risk. A transaction tax throws ‘sand in the wheels’ and reduces volatility. However, the evidence on whether this works in practice is mixed. Taxes that reduce trading may in fact increase volatility by reducing liquidity in the market. In addition, any benefits must be weighed against the costs associated with an increased cost of external finance for UK firms (since SDRT depresses share prices), which acts to reduce investment.

Generously, the jury is out on whether transaction taxes in financial markets are a good idea. Assuming they are, there is some logic to extending the tax to derivatives. However, in practice, it will be difficult to define derivatives broadly enough to ensure that firms cannot simply design a form of financial derivative that escapes the new tax.

Labour, and others, refer to this policy as the Robin Hood tax. This is highly misleading. It gives the impression that the tax is raised from rich people. It is not, at least not entirely. Extension of SDLT will directly reduce the investment returns to all of those that invest in derivatives and bonds (including indirectly through a pension). To the extent that it leads to lower investment by UK firms, it is also likely to have indirect effects on wages and prices. SDLT should not be seen simply as a tax on the owners or employees of financial sector firms.

None of the parties set out whether, and if so how, they would deal with the public finance hole that is growing as more people choose to work for their own business. It is now widely known that the self-employed and company owner-managers are taxed at lower rates than employees. These groups have accounted for 40% of the workforce growth since 2008 and by 2020/21 the continuation of that growth will cost the exchequer £4.5bn.

The Conservatives, having been burned by Phillip Hammond’s failed attempt to make a minor dent in the problem by increasing class 4 NICs, don’t say what they would do. But, the chancellor clearly set out in his u-turn speech that he still judges the scale of the NICs difference between employees and the self-employed to be a problem and ‘continues to believe that’ reducing the tax difference ‘is the right approach’. The manifesto has dropped the so-called ‘tax lock’, which is sensible because it allows the freedom to respond to unexpected events. This leaves open the possibility that a Conservative government post 8 June would try again to increase self-employed NICs, possibly alongside increased parental rights and revamped employment laws.

Labour have ruled out increases in NICs so would find it very difficult to level the playing field between employees and the self-employed.

Labour have set out a vision for a larger state, albeit one that would be more Canadian than Scandinavian in scale. They propose to pay for this by asking ‘the rich’ and companies to pay ‘a little more’. To start, £50bn is not a little more: it would represent a 6% increase in the total tax take. More importantly, they have made much of the idea that 95% of people won’t pay more tax. But this pledge applies only to the direct effect of their income tax policies. It is fanciful to think that the additional £50bn that they are seeking to raise would come solely from the top 5%. Instead, additional taxes on businesses would at least lead to lower returns to savers, including the millions of people that are indirectly shareholders through their private pensions. We’d also expect higher taxes to feed through into lower wages and higher prices. There is a choice we can make as a country to have a bigger state. That would not make us unusual in international terms. But we should be under no illusion that ‘someone else’ will be paying: we would all be chipping in.

On the face of it, the Conservatives are not proposing any new tax increases. However, they have set themselves the target of reaching a balanced budget by the middle of the next decade. To achieve this they would need to find further spending cuts (on top of the seven years of austerity we’ve just had and the five years pencilled in) or raise taxes. This choice would be made against the backdrop of an aging population and growing cost of healthcare which mean that the government would need to increase spending simply to maintain current service levels. The clear risk is that the Conservatives would not be able to deliver the promised spending cuts without serious damage to the quality of public services. It’s highly unlikely that we can have no tax increases, the same quality public services and a balanced budget; something is probably going to have to give.

Whoever wins on 8 June, in coming years we all face a choice about the size of the state and how it’s paid for. My guess is that taxes will rise regardless of who wins the election. That’s an evidence based guess. In the 12 months following the last six general elections (1992, 1997, 2001, 2005, 2010 and 2015), significant tax-raising measures were announced, despite these measures typically not featuring in the winning party’s general election manifesto. So, as the next 12 months progress, I’ll be watching out for the tax policies that weren’t in the manifestos.