The ATT has called on the government to consider reforming the ‘baffling’ VAT rules on food and drink as the tax passes its golden jubilee.

As the association points out, milkshake powders are taxed differently according to their flavour, with chocolate powers falling with zero-rating while other flavours are subject to the standard rate. Savoury popcorn is standard-rated, unless it’s microwave corn ‘sold for popping’, which is zero-rated.

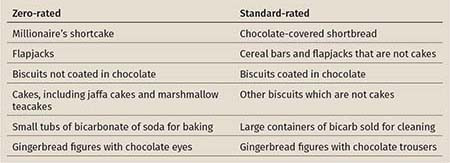

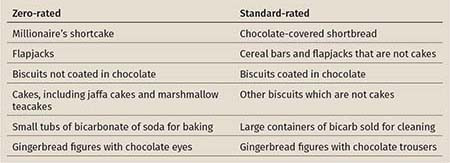

‘Confusing examples’ include:

Senga Prior, Chair of the ATT’s Technical Steering Group, said: ‘Many of the rules still in place today for food and drink derive from the old purchase tax regime, which was replaced with VAT when the UK joined the EU in 1973. As a result, they are often outdated and difficult to apply in the modern world.

‘This has led in the past to the Tax Tribunal having to consider cases such as whether Jaffa Cakes are a cake or a biscuit, and whether or not Pringles are crisps. The decisions in these cases often throw up results which sound utterly ridiculous to the average person.

‘Carrying out a modern-day revamp of these archaic rules will make things easier for everyone.’

The ATT has called on the government to consider reforming the ‘baffling’ VAT rules on food and drink as the tax passes its golden jubilee.

As the association points out, milkshake powders are taxed differently according to their flavour, with chocolate powers falling with zero-rating while other flavours are subject to the standard rate. Savoury popcorn is standard-rated, unless it’s microwave corn ‘sold for popping’, which is zero-rated.

‘Confusing examples’ include:

Senga Prior, Chair of the ATT’s Technical Steering Group, said: ‘Many of the rules still in place today for food and drink derive from the old purchase tax regime, which was replaced with VAT when the UK joined the EU in 1973. As a result, they are often outdated and difficult to apply in the modern world.

‘This has led in the past to the Tax Tribunal having to consider cases such as whether Jaffa Cakes are a cake or a biscuit, and whether or not Pringles are crisps. The decisions in these cases often throw up results which sound utterly ridiculous to the average person.

‘Carrying out a modern-day revamp of these archaic rules will make things easier for everyone.’